- UP RERA: UPRERAAGT10143

- info@sachanestate.in

Blog Details

Home / Blog Details

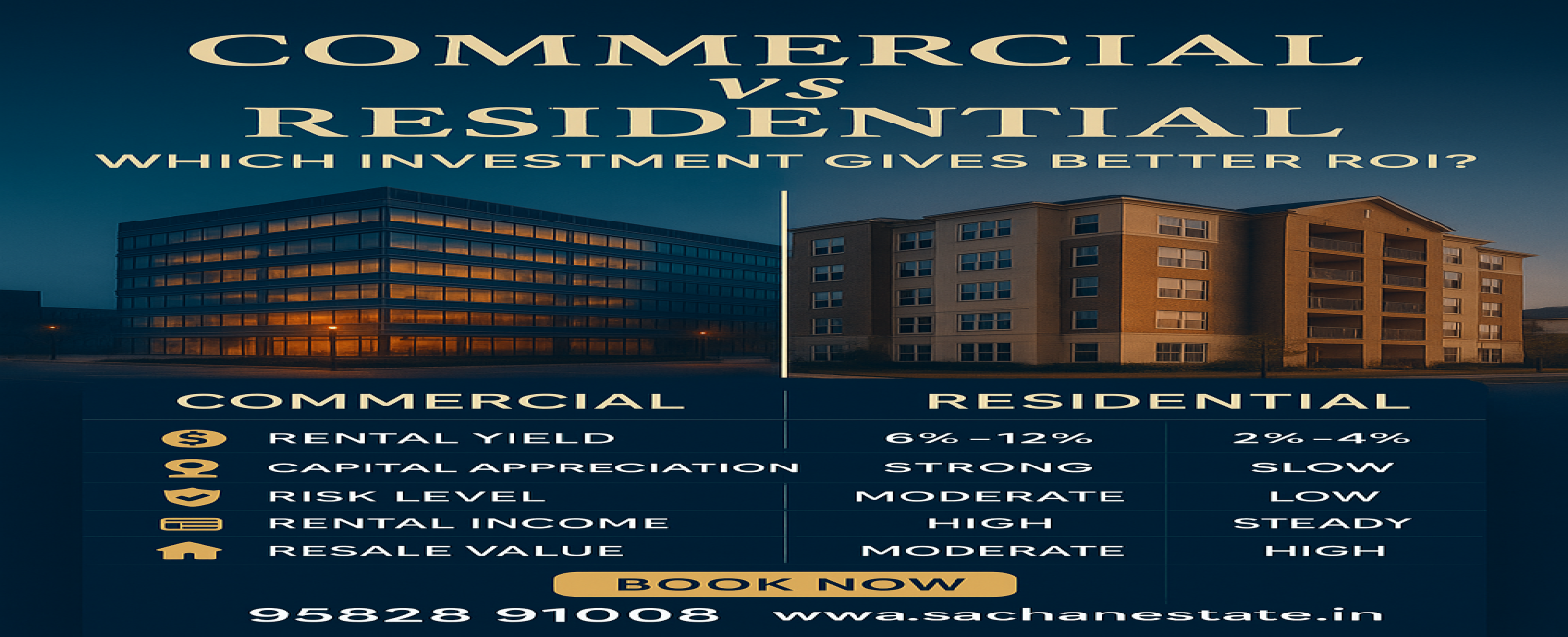

🏢 Commercial vs 🏠 Residential Real Estate: Which Gives Better ROI in India?

📊 Understanding ROI in Real Estate

Return on Investment (ROI) in property refers to the income generated through rental yields and the appreciation of the property’s value over time.

| Investment Type | Rental Yield (Avg) | Capital Appreciation | Risk Level | Ideal For |

|---|---|---|---|---|

| 🏢 Commercial | 6%–12% | ✅ Strong (10–20%) | ⚠️ Moderate | High-income investors, businesses |

| 🏠 Residential | 2%–4% | ⚠️ Slow (5–10%) | ✅ Low | End-users, first-time buyers |

🏢 Benefits of Commercial Property Investment

🔹 1. Higher Rental Yields

-

Commercial spaces in Sector 132 Noida, Knowledge Park, Cyberhub Gurgaon etc. offer 8–12% rental yields.

-

Long-term leases (3–9 years) = steady income

🔹 2. Appreciation in Business Zones

-

Offices and shops appreciate faster in prime commercial corridors like Noida Expressway, Raj Nagar Extension, and Golf Course Road.

🔹 3. Corporate Tenants = Reliable Income

-

Companies, banks, franchises, and MNCs are more stable tenants than individuals.

🔹 4. Lesser Maintenance Headaches

-

Fewer customizations, no regular repairs like in residential units.

🏠 Benefits of Residential Property Investment

🔹 1. Affordable Entry Point

-

Easier for first-time investors, with flats starting from ₹30–50 lakhs in Noida Extension or Ghaziabad.

🔹 2. Easier to Resell

-

More emotional buyers and families looking for homes = higher resale potential.

🔹 3. Tax Benefits

-

Section 80C and home loan interest benefits up to ₹2 lakh.

🔹 4. Ready Demand for Rental Homes

-

In areas near IT parks, colleges, and metros — flats are always in demand.

⚖️ Comparison: Commercial vs Residential ROI

| Feature | Commercial Property | Residential Property |

|---|---|---|

| 🔁 Rental Yield | ✅ 6%–12% | ⚠️ 2%–4% |

| 📈 Capital Appreciation | ✅ Faster in cities | ⚠️ Slower |

| 📊 Tenant Type | Corporates, Brands | Families, Students |

| 🧾 Tax Benefits | Limited | ✅ More under Income Tax |

| 🧱 Maintenance | Low | ⚠️ High (interiors, society) |

| 🛒 Liquidity | Moderate | ✅ Higher resale demand |

| 🔐 Risk Factor | ⚠️ Market-sensitive | ✅ Stable demand |

📍 2025 Trending Locations for High ROI

🏢 Commercial Hotspots

-

Noida Sector 132, 135 (Exotica, ATS)

-

Greater Noida Knowledge Park

-

Wave City Ghaziabad

-

Golf Course Road, Gurugram

🏠 Residential High Growth Sectors

-

Noida Extension (Sec 1, 2, Techzone 4)

-

Indirapuram, Vaishali

-

Greater Noida West

-

Crossing Republik

📉 Risks to Consider

⚠️ Commercial Risks:

-

Economic slowdowns affect business rentals

-

Longer vacancy periods

-

Dependent on location footfall

⚠️ Residential Risks:

-

Rental income often doesn’t match EMI

-

High maintenance, society charges

-

Slower resale in underdeveloped zones

📝 Final Verdict: Which One Wins?

✅ Choose Commercial If:

-

You want high ROI, long-term tenants, and premium appreciation

-

You can handle ₹50L+ investment & longer holding period

-

You want to lease to brands or corporates

✅ Choose Residential If:

-

You’re looking for low-risk, easier entry investment

-

You want rental + emotional resale value

-

You’re planning for personal/family use later

🏁 Conclusion

Commercial real estate clearly offers better ROI if you have the budget, patience, and pick the right location like Noida Expressway, Gurugram, or Sector 132 Noida.

Residential investment offers stable demand and lower volatility, but the ROI is typically lower.

📱 Need help deciding or booking a commercial/residential space in NCR?

🔑 We bring exclusive listings, site visits, and early-bird offers!

📞 Call: 95828 91008

🌐 Visit: www.sachanestate.in